In the latest Rent

vs. Buy Report from Trulia, they explained that

homeownership remains cheaper than renting with a traditional 30-year fixed

rate mortgage in the 100 largest metro areas in the United States. The

updated numbers actually show that the range is an average of 5% less

expensive in Orange County (CA) all the way up to 46% in Houston (TX), and 36%

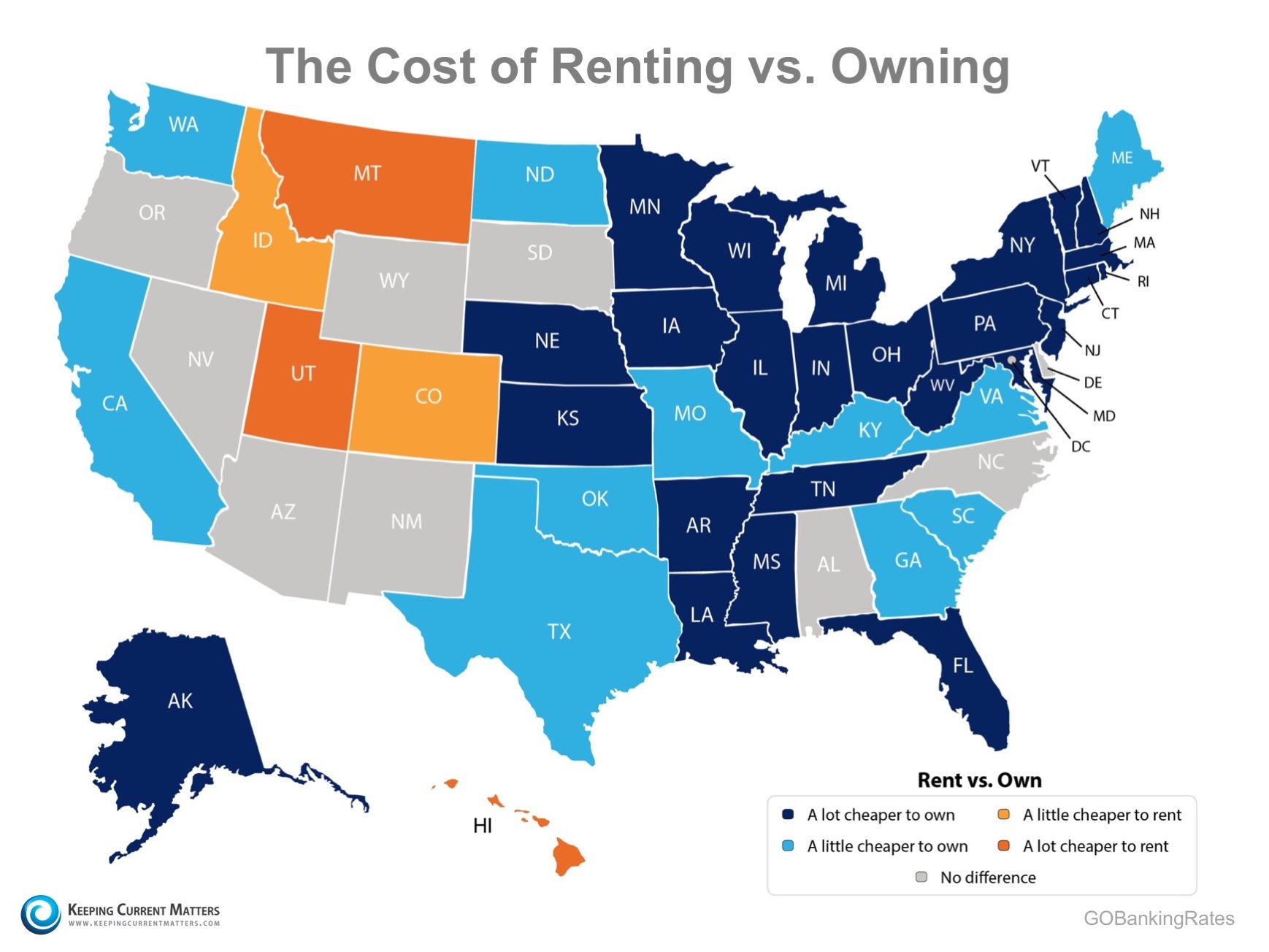

Nationwide! A recent study

by GoBankingRates looked at the cost of renting vs. owing a home at

the state level and concluded that in 36 states it is actually 'a little' or

'a lot' cheaper to own, represented by the two shades of blue in the map

below. In the latest Rent

vs. Buy Report from Trulia, they explained that

homeownership remains cheaper than renting with a traditional 30-year fixed

rate mortgage in the 100 largest metro areas in the United States. The

updated numbers actually show that the range is an average of 5% less

expensive in Orange County (CA) all the way up to 46% in Houston (TX), and 36%

Nationwide! A recent study

by GoBankingRates looked at the cost of renting vs. owing a home at

the state level and concluded that in 36 states it is actually 'a little' or

'a lot' cheaper to own, represented by the two shades of blue in the map

below.  One of the main reasons

that owning a home has remained significantly cheaper than renting is the

fact that interest rates have remained at or near historic lows. Freddie

Mac reports that rates fell

again last week to 3.43%. One of the main reasons

that owning a home has remained significantly cheaper than renting is the

fact that interest rates have remained at or near historic lows. Freddie

Mac reports that rates fell

again last week to 3.43%. Nationally, rates would have to rise to 10.6% for renting to be cheaper than buying - and rates haven't been that high since 1989.Bottom Line

Buying

a home makes sense socially

and financially.

If you are one of the many renters who would like to evaluate your ability to

buy this year, meet with a local real estate professional who can help you

find your dream home.

|

ShirLee's Homes4SaleUtah BLOG

ShirLee McGarry's Homes4SaleUtah BLOG, features great articles for consumers, homeowners and Realtors® addressing community, local, state and national real estate news.

Articles also include refreshing humor to encourage smiles and support for all real estate warriors in the trenches who do stand out to make a difference in their client's lives in the exciting and challenging world of the Realtor®.

Penned by Associate Broker-Realtor®,and Registered Author, ShirLee McGarry® with RealtyPath in Sandy, Utah

Wednesday, August 10, 2016

Buying Remains 36% Cheaper than Renting!

Friday, May 27, 2016

HOME SALES CLMBING HIGHEST SINCE 2006

New & Existing Home Sales Climb [INFOGRAPHIC]

Thursday, May 26, 2016

TRUST IS NECESSARY

Unparalleled Trust Necessary Before Listing Your House

|

You and your family have decided to

sell your house. It is now time to choose a real estate professional to help

with the process. One of the major attributes this agent must possess is

trustworthiness. To what degree do you need to trust them? You must have

enough trust in them that you feel comfortable they will accomplish all four

things below:

1. Sell possibly the largest asset your family owns

In

many cases, a home is the largest asset a family has. Studies have shown that

the equity many families have in their home is the largest percentage of that

family's overall wealth.

2. Set the correct market value on that asset

Pricing

is crucial even in the best of markets. You want to get the best price for

your home without putting your house at a value that buyers will have little

interest in.

3. Set the time schedule for the liquidation of that asset

Your

family probably has a certain timetable for the sale of your house and the

move into your next home. Coordinating the home selling process to meet

certain schedules can be tricky.

4. Set a fair fee for the services required to liquidate that asset

You

will need to pay a commission to an agent for selling the home and

coordinating all elements of the selling transaction, including possible

future negotiations (ex. with a home inspector or appraiser). That's a lot of

trust. Make sure you pick a true professional to help with the sale of your

home.

|

Subscribe to:

Comments (Atom)